State Pension Increase 2024 | What You’ll Now Get

Estimated Reading Time: 7 minutes

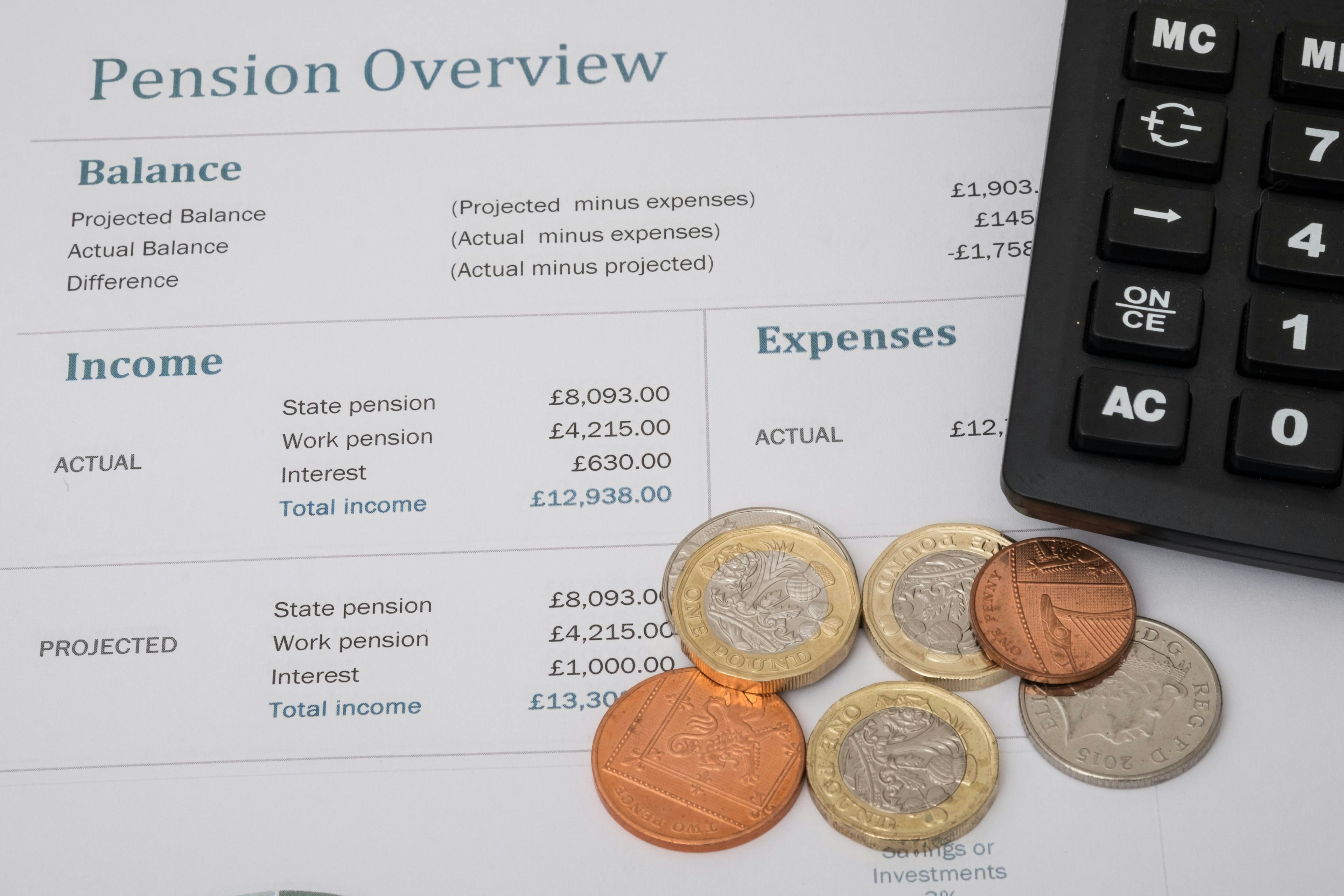

Did you know the State Pension isn’t a fixed amount? This regular government payment increases each tax year - often in line with inflation - and we’ve explained the State Pension increase for 2024 here.

We’ve also explained how much State Pension you could get, how to claim it, how the triple lock works and how a State Pension increase affects your retirement planning.

Where would you like to live?

Browse the best retirement homes near you through Lottie.

In this article:

- What is the State Pension?

- How much is the State Pension for 2024?

- How much did the State Pension increase in 2023?

- How much State Pension you’ll get

- Why is the State Pension increasing?

- How to claim

What Is the State Pension?

The State Pension is a government benefit that most people can begin claiming when they reach the State Pension age.

How much State Pension you’re eligible to receive depends on how many ‘qualifying years’ of National Insurance (NI) contributions you’ve built up. We’ve explained this in more detail later on.

When do you get the State Pension?

The current State Pension age is 66, but exactly when you’re able to claim will depend on when you were born.

You can check when you’ll be eligible using the GOV.UK State Pension age calculator.

The State Pension age is due to increase to 67 between 2026-2028. This is because of demographic changes, such as a rising life expectancy.

How Much Is the State Pension For 2024?

The full new State Pension increased from £203.85 to £221.20 a week in April 2024. The full new State Pension is now worth £958.53 a month and £11,502.40 a year.

This was an increase of 8.5%, in line with inflation and the full State Pension triple lock.

Meanwhile, the full basic State Pension is now worth £169.50 a week, having previously been £156.20. The full basic State Pension is now worth £734.50 a month and £8,814 a year.

How Much Did the State Pension Increase In 2023?

The State Pension increased by 8.5% from the 6th of April 2024, in line with inflation.

As a result of this increase, anybody receiving the full Basic State Pension will earn an extra £13.30 per week, while anybody receiving the full New State Pension will get an extra £17.35 per week.

The State Pension isn’t affected by whether you’re in a couple or are single.

We’ve summarised this increase on a weekly, monthly and annual basis in the tables below.

Basic State Pension

| 2024/25 | 2023/24 | Increase | |

|---|---|---|---|

| Weekly Rate | £169.50 | £156.20 | £13.30 |

| Monthly Rate | £734.50 | £676.87 | £57.63 |

| Annual Rate | £8,814 | £8,122.40 | £691.60 |

New State Pension

| 2024/25 | 2023/24 | Increase | |

|---|---|---|---|

| Weekly Rate | £221.20 | £203.85 | £17.35 |

| Monthly Rate | £958.53 | £883.35 | £75.18 |

| Annual Rate | £11,502.40 | £10,600.20 | £902.20 |

We can help you find the perfect UK retirement home. Use our free service to filter by location, price, the facilities available, purchase type and more!

How Much State Pension You’ll Get

How much State Pension you’ll get depends on whether you’re eligible for the Basic or New State Pension and how many qualifying years you’ve built up.

You can check your State Pension forecast to see how much you could receive and when you can begin claiming.

Over 20 million people have checked their forecast online to help better plan for retirement.

Basic State Pension

You’ll be eligible for the Basic State Pension if you’re:

- A man born before the 6th of April 1951

- A woman born before the 6th of April 1953

To claim the full Basic State Pension, you’ll need either 30 or 44 qualifying years as a man, or 30 or 39 qualifying years as a woman (depending on when you were born). If you have fewer qualifying years than this, your Basic State Pension will be reduced.

Check your National Insurance record to see how many qualifying years you have.

| Full Basic State Pension (2024/25) | Full Basic State Pension (2023/24) | Annual Increase |

|---|---|---|

| £169.50 a week | £156.20 a week | £13.30 |

You could also get extra through the Additional State Pension. There’s no set amount of Additional State Pension - it’s determined by things like your earnings and how many years you paid NI contributions for.

New State Pension

You’ll be eligible for the New State Pension if you’ve reached State Pension age and are:

- A man born on or after the 6th of April 1951

- A woman born on or before the 6th of April 1953

You’ll usually need at least ten qualifying years on your National Insurance record to receive any New State Pension. You’ll get the full New State Pension if you have at least 35 qualifying years.

Check your National Insurance record to see how many qualifying years you have.

| Full New State Pension (2024/25) | Full New State Pension (2023/24) | Annual Increase |

|---|---|---|

| £221.20 a week | £203.85 a week | £17.35 |

Why Is the State Pension Increasing?

In the UK, the State Pension increases at the beginning of each tax year (on the 6th of April). This increase occurs as a result of several factors, with these being known as the ‘triple lock’.

State Pension triple lock

A triple lock was introduced to the UK State Pension in 2010. This triple lock acted as a guarantee that the State Pension wouldn’t lose any value in real terms, and that as a minimum, it would increase in line with inflation.

The State Pension has increased each year in line with the triple lock commitment since 2010 - apart from when it was suspended in 2022.

Through the triple lock, the State Pension increases each year in line with the highest out of:

- Consumer price inflation (CPI) - this was previously known as Retail Price Index (RPI)

- Average wage growth

- 2.5% (if the two above figures are both lower than this number)

Last September’s inflation rate was 10.1% (the highest of the three factors above), so this was used to calculate State Pension growth for 2023.

Other pensions - such as personal and workplace pensions - aren’t affected by the triple lock. These have their own pension pots which rely on the performance of underlying investments.

State Pension increases from 2011/12 to present day:

| Tax Year | How Much Did the State Pension Increase By? | What Determined This Increased? |

|---|---|---|

| 2011/12 | 4.6% | RPI |

| 2012/13 | 5.2% | CPI |

| 2013/14 | 2.5% | 2.5% |

| 2014/15 | 2.7% | CPI |

| 2015/16 | 2.5% | 2.5% |

| 2016/17 | 2.9% | Wage growth |

| 2017/18 | 2.5% | 2.5% |

| 2018/19 | 3% | CPI |

| 2019/20 | 2.6% | Wage growth |

| 2020/21 | 3.9% | Wage growth |

| 2021/22 | 2.5% | 2.5% |

| 2022/23 | 3.1% | CPI |

| 2023/24 | 10.1% | CPI |

Source: House of Commons Library - State Pension triple lock

How To Claim the State Pension

In most cases, you’ll receive a letter from the Pension Service around four months before you reach State Pension age. This letter will explain how to claim your pension.

When applying, you’ll need to provide your National Insurance number.

Most people claim their State Pension online through GOV.UK.

You can also claim over the phone by calling the Pension Service on 0800 731 7898 between 8am and 6pm, Monday to Friday.

The final option is to phone the Pension Service and get them to send you a State Pension claim form.

If you haven’t received a letter within two months of reaching the State Pension age, you should call the Pension Service on 0800 731 7898.

We’re on a mission to support individuals and their loved ones throughout each stage of their later living journey. For more information, check out everything Lottie has to offer.

Frequently Asked Questions

Should I defer my State Pension?

There are advantages and disadvantages to deferring your State Pension. If you intend to continue working beyond the State Pension age (currently 66), then it could make sense to delay receiving your State Pension.

By deferring, you’ll pay less tax later on. So, if you don’t currently need the extra income and you know you’ll drop a tax bracket when you stop working, this is something you should consider.

Can I claim my State Pension and continue working?

You can receive your State Pension and continue working. There’s no longer a compulsory retirement age, so reaching the State Pension age doesn’t mean you have to stop working.

Why is the old State Pension less than the New State Pension?

The old system is less than the New State Pension because you’ll have likely paid National Insurance contributions at a lower rate. It’s also possible that some of these contributions were used towards your stakeholder or personal pension, rather than your Additional State Pension.