Benefits For Pensioners Over 70 | Boost Your Retirement Income

Estimated Reading Time: 15 minutes

When you reach the State Pension age and beyond, there are a range of benefits available to you. These are aimed at older adults (such as State Pension benefits and travel discounts), while there are also benefits for disabled people and their carers.

Knowing which benefits you are and aren’t eligible for will greatly boost your income in later life! Here, we’ve gone over each of these benefits for pensioners, including what it is, what you’ll receive, whether you’re eligible and how to claim.

Where would you like to live?

Browse the best retirement homes near you through Lottie.

Here’s a full list of benefits for pensioners you may be eligible for:

- State Pension benefits

- Benefits to help heat your home

- Travel-related benefits

- Benefits for disabled individuals and carers

- Military pension benefits

- Other benefits

- Discounts and freebies

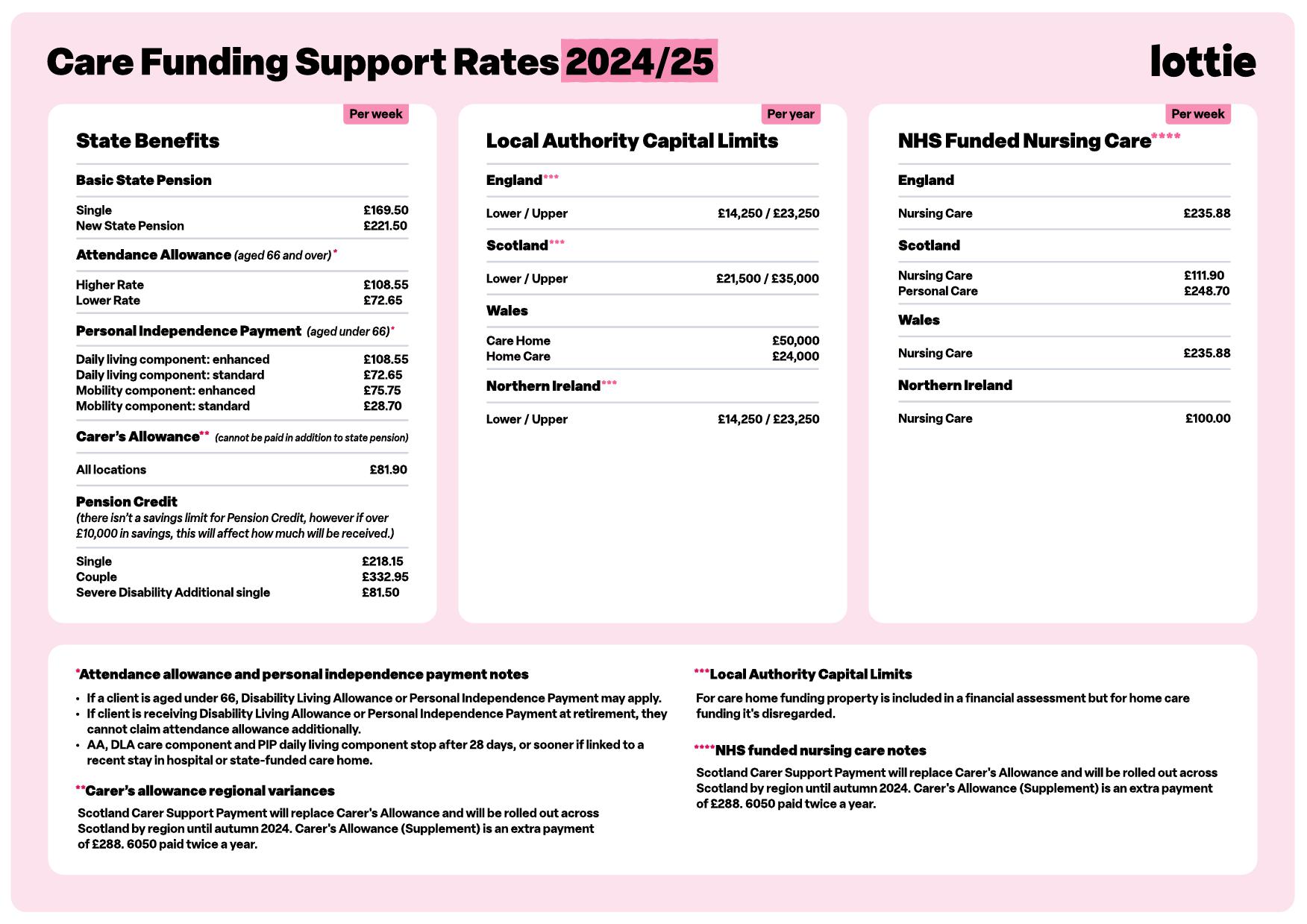

Here are the 2024/2025 care funding support and benefit rates, including for many of the benefits discussed in this article:

State Pension Benefits

The UK State Pension age is currently 66 for men and women, so the benefits below are aimed at people who have reached this age.

Basic State Pension

What is it?

The State Pension is a payment from the government, based on the National Insurance (NI) contributions you’ve made across your working life.

The Basic State Pension is for people who have reached the State Pension age and have enough NI qualifying years.

What you’ll get

The amount you’ll receive depends on your National Insurance record and how many qualifying years you have. A qualifying year is one in which you were working and paying National Insurance, received National Insurance credits or paid voluntary National Insurance contributions.

The full Basic State Pension for 2024/25 is £169.50. The State Pension increased by 8.5% in April 2024. To qualify for this, you’ll need a certain number of qualifying years (between 30 and 44 for men, and between 30 and 39 for women) - you can check your National Insurance record here.

Are you eligible?

You need to be either a:

- Man born before 6th April 1951

- Woman born before 6th April 1953

How to claim

Fill in the Basic State Pension claim form here.

New State Pension

What is it?

The New State Pension is gradually replacing the Basic State Pension - as it’s for men and women in the UK born after a certain date. You can begin receiving the New State Pension when you reach the State Pension age.

What you’ll get

The full new State Pension is £221.20 per week.

You’ll usually need a minimum of 10 qualifying years on your National Insurance record to receive any State Pension (these don’t have to be consecutive). You’ll need 35 qualifying years to get the full new State Pension.

Are you eligible?

You need to either be a:

- Man born on or after 6th April 1951

- Woman born on or after 6th April 1953

How to claim

Apply for the New State Pension here.

You should automatically receive a letter telling you how to claim around four months before you’re due to reach State Pension age. If you haven’t received a letter, you can instead request an invitation code to apply online.

Pension Credit

What is it?

If you’re over the State Pension age and you are on a low income, Pension Credit will provide you with additional money to help with the cost of living. Pension Credit is separate from your State Pension.

Pension Credit is comprised of two different elements - Guarantee Credit and Savings Credit.

There are several other circumstances in which you might get extra help as well, and we’ve listed these below.

What you’ll get

Pension credit tops up:

- Your weekly income to £218.15 if you’re single

- Your joint weekly income to £332.95 if you have a partner

You could also be eligible to receive further payments through Pension Credit:

- An additional £81.50 a week if you have a life-changing disability

- An additional £45.60 a week if you care for another adult

- An extra £66.29 or £76.79 a week for each child or young person you’re responsible for (this amount becomes higher if this child or young person is disabled and qualifies for certain benefits)

You can use the Pension Credit calculator to work out how much you’re eligible to receive. We also have a guide explaining how much Pension Credit is a week.

Are you eligible?

To be eligible, you must live in England, Scotland or Wales, and have reached the State Pension age. If applying for you and your partner, you must have both reached the State Pension age.

How to claim

Apply for Pension Credit here.

Benefits To Help Heat Your Home

The following benefits can be claimed at certain times of the year (usually the winter months) and renewed annually, meaning if eligible, you’ll receive them every year.

Cold Weather Payment

What is it?

The Cold Weather Payment provides you with an amount of money for each seven-day period in which the average temperature in your area is recorded as (or forecast to be) 0°C or below. Between 1st November 2023 and 31st March 2024, this is paid out at £25 for each seven-day period.

The 2023 to 2024 Cold Weather Payment Scheme began on 1st November 2023.

What you’ll get

You’ll get £25 for every seven days of cold weather.

Are you eligible?

You may be eligible for a Cold Weather Payment if you receive any of the following benefits:

- Pension Credit

- Income Support

- Income-based Jobseeker’s Allowance

- Income-related Employment and Support Allowance

- Universal Credit

- Support for Mortgage Interest

There isn’t a Cold Weather Payment scheme in Scotland. You may instead be eligible for an annual £50 Winter Heating Payment You’ll receive this, regardless of weather conditions in your local area.

How to claim

There’s no need to apply for the Cold Weather Payment scheme. If eligible, you’ll automatically be paid it.

Warm Home Discount

What is it?

The Warm Home Discount is a one-off discount on your electricity bill. You won’t receive this money - instead, it’ll be directly taken off your bill. If your supplier provides you with gas and electricity, you may instead be able to get this money taken off your gas bill.

The Warm Home Discount scheme for 2023 to 2024 has now closed. This opened in October 2023. It will reopen in October 2024. Check the Warm Home Discount page for more details.

What you’ll get

Under the 2022/23 Warm Home Discount, people had £150 taken off of their electricity bill.

Are you eligible?

You’ll qualify if you live in England or Wales and:

- Receive the Guarantee element of Pension Credit

- Or are on a low income and have high energy costs

You’ll qualify if you live in Scotland and:

- Receive the Guarantee element of Pension Credit

- Or are on a low income and meet your energy supplier’s criteria

This scheme isn’t available in Northern Ireland.

How to claim

If you’re eligible, you’ll receive a letter telling you about the discount. Most households will automatically receive this discount, so there’s no need to apply.

Winter Fuel Payment

What is it?

The Winter Fuel Payment is an annual tax-free benefit for households including someone born before 26th September 1956. It aims to help cover heating-related costs during the winter.

What you’ll get

Depending on your circumstances, you could receive between £250 and £600 to help pay your heating bills.

This amount includes a ‘Pensioner Cost of Living Payment’ which is between £150 and £300. You’ll receive this additional amount in Winter 2022 to 2023 and Winter 2023 to 2024.

There's also a separate £900 Cost of Living Payment.

Are you eligible?

This scheme is aimed at people living in the UK born before 26th September 1956.

If you live in a care home, you can also get a Winter Fuel Payment.

However, you won’t be eligible if you:

- Have received free treatment in hospital for more than a year

- Require permission to enter the UK and your granted leave says you’re unable to claim public funds

- Were in prison for the entire week of the 19th to 25th of September 2022

How to claim

If eligible, the majority of people will automatically receive the Winter Fuel Payment (such as if you’re above the State Pension age or receive a benefit such as Pension Credit, Attendance Allowance, Personal Independence Payment, Carer’s Allowance or Disability Living Allowance).

If eligible, you should have received a letter between October and November 2022 saying how much you’ll receive.

Travel Benefits

If you’re above the State Pension age in the UK, there are several transport-related discounts and benefits you’re eligible for across rail, buses and more.

Free and discounted public transport

What is it?

A range of free and discounted public transport options are available to people above certain ages in the UK.

What you’ll get

Free bus pass - You can travel for free on buses in England when you reach the State Pension age, when you turn 60 in Wales and Scotland, and when you turn 60/65 in Northern Ireland

60+ Oyster photocard - This allows you to travel for free on buses, tubes, the Overground and trams in London from the age of 60. Apply online for a 60+ Oyster photocard

National Express - Purchasing a Senior Coachcard for £12.50 will get you 1/3 off travel. This card will last you for a year and you must be aged 60 or over. Order a Senior Coachcard here

Senior Railcard - Save 1/3 on rail travel. A Senior Railcard costs £30 for one year, or £70 for three years. You must be aged 60 or over. Order a Senior Railcard here

Are you eligible?

To be eligible, you’ll need to have reached the relevant age, depending on what it is you wish to apply for (we’ve stated these above).

How to claim free bus travel

Apply for an older person’s bus pass in England or Wales.

Contact your local authority to apply for a National Entitlement Card in Scotland.

Follow the steps here to apply for a SmartPass (60+) or Senior SmartPass (65+) in Northern Ireland.

Healthcare Travel Costs Scheme

What is it?

As we age, hospital visits may become more frequent. If you already receive certain benefits for pensioners or older adults, you can cover the costs of travelling to and from the hospital or a different health facility through the Healthcare Travel Costs Scheme (HTCS).

What you’ll get

The amount you’ll receive depends on how much you’ve spent on transport - whether that’s public transport or by car.

Those handling your claim will normally refund based on what would have been the cheapest form of transport for your circumstances. In most cases, this is public transport such as a bus or train.

Are you eligible?

You may be eligible for the Hospital Travel Costs Scheme if you receive:

- The Guarantee Credit element of Pension Credit

- Income Support

- Jobseeker’s Allowance

- Employment and Support Allowance

How to claim

To claim hospital travel costs, take your travel receipts and proof you’re receiving one of the relevant benefits to a nominated cashier’s office (these are located in the hospital or clinic where you’ve been treated). They’ll directly make the payment to you.

If a hospital or clinic doesn’t have cashier facilities, you can instead complete a HC5(T) Refund Claim Form and post it to the address given on the form.

You can make a postal claim up to three months after your appointment.

We can help you find the perfect UK retirement home. Use our free service to filter by location, price, the facilities available, purchase type and more!

Benefits For Disabled Individuals and Carers

If you have a disability or care for someone else who does, there are several financial benefits available. Some of these are age-specific and aimed at people over the State Pension age, while others aren’t age-specific, so can be claimed by people of all ages.

Attendance Allowance

What is it?

Attendance Allowance is a State Pension age benefit for people living in the UK with disabilities that require somebody else to care for them. Attendance Allowance doesn’t cover mobility needs.

What you’ll get

Attendance Allowance is paid at two separate rates. The rate you receive depends on how much support you require.

| Rate | Amount You’ll Receive | Amount of Support You Require |

|---|---|---|

| Lower Rate | £72.65 | Frequent help and supervision during the day, or some supervision at night |

| Higher Rate | £108.55 | Help and supervision throughout the day and at night |

Are you eligible?

You’ll be eligible for Attendance Allowance if you’ve reached State Pension age and the following apply:

- You have a physical or mental disability

- You need help caring for yourself, or require someone to care for you

- You’ve needed this help for at least six months

We have an article dedicated to which medical conditions qualify for Attendance Allowance.

How to claim

To claim, either:

- Print, fill out and submit the Attendance Allowance claim form (send the completed form to ‘Freepost DWP Attendance Allowance’)

- Get in touch with the helpline to request a claim form, then fill it out and submit it (call the Attendance Allowance helpline on 0800 731 0122).

Constant Attendance Allowance

What is it?

Constant Attendance Allowance is for people who receive Industrial Injuries Disablement Benefit or a War Disablement Pension and require daily support because of a disability.

What you’ll get

There are four different Constant Attendance Allowance rates. The amount you’ll receive depends on how your disability affects you and how much support you require.

| Rate | Weekly Amount |

|---|---|

| Exceptional Rate | £177.40 |

| Intermediate Rate | £133.05 |

| Full Day Rate | £88.70 |

| Part Day Rate | £44.35 |

Are you eligible?

To be eligible, you must claim one of the following:

- Industrial Injuries Disablement Benefit (we’ve explained this benefit with this article)

- War Disablement Pension (also known as a War Pension Scheme, we’ve explained this benefit with this article)

Industrial Injuries Disablement Benefit

What is it?

Industrial Injuries Disablement Benefit (IIDB) is a benefit for people who have a disability as a result of an accident at work, or who have certain diseases caused by work.

What you’ll get

The amount you’ll receive depends on your personal circumstances. You’ll be assessed to determine your level of disability on a scale of 1% to 100%.

Below, we’ve provided guidelines as to how much you may receive weekly, depending on your assessed level of disability. The actual amount may differ:

| Assessed Level of Disability | Weekly Amount |

|---|---|

| 100% | £221.50 |

| 90% | £199.35 |

| 80% | £177.20 |

| 70% | £155.05 |

| 60% | £132.90 |

| 50% | £110.75 |

| 40% | £88.60 |

| 30% | £66.45 |

| 20% | £44.30 |

Are you eligible?

You may be eligible to claim Industrial Injuries Disablement Benefit if you’re disabled or became ill due to an accident or disease either:

- At work

- On an employment training scheme or course

How to claim

To apply, you’ll need to fill in and post a claim form. For an accident caused by work, fill in the BI100A form. For an illness or disease caused by work, fill in the BI100PD form.

You can also ask the Barnsley Industrial Injuries Disablement Benefit Centre to send you a claim form. Call them on 0800 121 8379.

Personal Independence Payment

What is it?

Personal Independence Payment (PIP) is a benefit to help with additional living costs caused by:

- A long-term physical or mental health condition or disability

- Difficulty with everyday tasks or getting around as a result of your condition

What you’ll get

There are two parts to Personal Independence Payment. You may need just one or both of these parts:

- Daily living part - If you require help with everyday tasks

- Mobility part - If you require help with getting around

The Department for Work and Pensions (DWP) will assess how difficult you find day-to-day tasks and getting around, to determine which part(s) you qualify for

Here are the Personal Independence Payment rates and amounts for 2024/25:

| Lower Weekly Rate | Higher Weekly Rate | |

|---|---|---|

| Daily Living Part | £72.65 | £108.55 |

| Mobility Part | £28.70 | £75.75 |

You could also be able to claim several PIP freebies worth thousands of pounds.

Are you eligible?

You’re eligible for Personal Independence Payment if the following all apply:

- You’re aged 16+

- You have a long-term physical or mental health condition or disability

- You find certain everyday tasks difficult, or you have limited mobility

- You expect these difficulties to last for at least 12 months from when they began

Here’s the list of medical conditions that are eligible for PIP in the UK.

How to claim

To claim Personal Independence Payment, you’ll need to call the ‘PIP New Claims line’ at 0800 917 2222. You’ll then be sent a form asking about your condition. Complete and return this form as soon as possible. If more information is needed, you may also need to have an assessment.

In Scotland, you should instead apply for Adult Disability Payment.

Disability Living Allowance

What is it?

Disability Living Allowance is a tax-free, monthly benefit for disabled people which is gradually being replaced by other benefits such as Personal Independence Payment.

We have a guide explaining what illnesses qualify for Disability Living Allowance and DLA rates for 2023.

What you’ll get

Disability Living Allowance comprises two components - the ‘care component’ and the ‘mobility component’. You could be eligible for one or both of these.

| Care Component | Weekly Rate | Amount of Support You Require |

|---|---|---|

| Lowest | £28.70 | Help during some of the day |

| Middle | £72.65 | Help throughout the day or at night |

| Highest | £108.55 | Help throughout the day and at night, often including medical support |

| Mobility Component | Weekly Rate | Amount of Support You Require |

|---|---|---|

| Lower | £28.70 | Guidance or supervision when outdoors |

| Higher | £75.75 | A more severe or limiting condition, with walking requiring greater assistance |

Are you eligible?

You can only claim Disability Living Allowance if:

- You were born before 8th April 1948 and are already claiming it

- You’re claiming on behalf of a disabled person aged under 16

How to claim

People aged over 16 can no longer apply for Disability Living Allowance. You should instead apply for:

Attendance Allowance - If you’re over the State Pension age and don’t currently receive Disability Living Allowance

Personal Independence Payment - If you live in England or Wales and haven’t reached the State Pension age)

Adult Disability Payment - If you live in Scotland and haven’t reached the State Pension age)

If you were born on or before 8th April 1948, you’ll continue receiving Disability Living Allowance as long as you’re eligible for it.

If you were born after 8th April 1948, your Disability Living Allowance will eventually end. You’ll receive a letter telling you when this happens, and you don’t need to do anything until this letter arrives.

Carer’s Allowance

What is it?

If you spend a large amount of time (at least 35 hours a week) caring for somebody with an illness or disability, you may be entitled to the Carer’s Allowance benefit.

What you’ll get

You could receive £81.90 a week (2024/25) if you care for somebody at least 35 hours a week and this person receives certain benefits.

Be aware that Carer’s Allowance can affect or stop certain other benefits. Learn more about the effect it’ll have on other benefits here.

Are you eligible?

To be eligible, you need to spend at least 35 hours a week caring for somebody. You don’t have to be related to, or live with, this person. Caring for someone can include things like helping with household tasks and providing transport where needed.

The person you care for must receive a benefit too, such as Personal Independence Payment (the daily living component), Disability Living Allowance (the middle or highest care rate) or Attendance Allowance.

How to claim

Make a Carer’s Allowance claim here.

Military Pension Benefits

There are also benefits specifically aimed at Armed Forces veterans and their spouses or partners. Though these aren’t necessarily age-specific, they’re most commonly claimed by older adults and pensioners aged over 70.

War Widow’s or Widower’s Pension

What is it?

The War Widow’s or Widower’s Pension is paid to widows or widowers and the children of somebody killed in the Armed Forces, or somebody who later passed away as a result of an injury that occurred while serving in the Armed Forces.

What you’ll get

The War Widow’s or Widower’s Pension is paid at various tax-free rates, depending on your age and personal circumstances.

Here are the most recent rates (from April 2022).

Are you eligible?

To be eligible for this scheme, your husband, wife or civil partner will have passed away as a result of serving in the UK Armed Forces before 6th April 2005.

There are several other similar ways you may be eligible. Click here to learn more about eligibility for this benefit.

How to claim

To claim the War Widow’s or War Widower’s Pension, you can either:

- Download and fill in the claim form

- Phone Veterans UK and ask for a claim form

Then, send the completed form to:

Veterans UK

Norcross

Thornton Cleveleys

Lancashire

FY5 3WP

War Pension Scheme

What is it?

This is a compensation scheme for war veterans who have developed illnesses or injuries, or their pre-existing illnesses or injuries have been made worse, as a result of serving in the UK Armed Forces.

What you’ll get

The type of War Pension scheme you’ll enter depends on the extent of your disability:

- If your disability is assessed as less than 20%, you’ll receive a one-off lump sum payment

- If your disability is assessed at 20% or more, you’ll receive a weekly or monthly pension

View the amount you’ll receive from April 2023, depending on your personal circumstances.

Are you eligible?

You’re eligible to claim under the War Pension Scheme if you’re no longer serving in the UK Armed Forces and your disability arose before 6th April 2005.

How to claim

To make a claim, visit the Apply for Armed Forces Compensation or a War Pension page.

Other Benefits

Housing benefit

What is it?

If you’re unemployed, on a low income or are claiming other benefits, Housing Benefit can help you pay your rent. Housing Benefit is also aimed at people who have reached the State Pension age.

What you’ll get

The amount you’ll receive depends on a variety of factors, including whether you rent privately, or rent with council or social housing. The amount you’ll receive also depends on household income, personal circumstances and your ‘eligible rent’. ‘Eligible rent’ is the amount used to work out your Housing Benefit claim. This is your actual rent, plus any service charges you have to pay (but not bills such as water or gas).

There’s no set amount of Housing Benefit you’ll receive.

Are you eligible?

To make a new Housing Benefit claim, either of the following need to apply:

- You’ve reached the State Pension age

- You’re currently living in temporary, supported or sheltered housing

If your savings are above £16,000 then you usually won’t be eligible, unless you receive the Guarantee Credit part of Pension Credit.

How to claim

You can apply:

- By contacting your local council

- As part of a Pension Credit claim (if eligible)

Council tax reduction

What is it?

Also known as Council Tax Support, a Council Tax Reduction means paying less council tax on your monthly bill. You apply for a reduction through your local council. We have a guide explaining whether pensioners pay Council Tax.

What you’ll get

The size of the Council Tax Reduction you’ll receive depends on:

- Whereabouts you live

- Personal circumstances

- Household income

- If children or other adults live with you

Your bill could potentially be reduced by up to 100%.

Are you eligible?

You may be eligible if you’re on low income or claim other benefits. You can apply if you own your own home or rent.

How to claim

Apply for a Council Tax Reduction here.

Discounts and Freebies

Free TV licence (and discounted television)

What is it?

When you reach a certain age in the UK (currently 75), you can get a free TV licence. Usually, a TV licence costs £159 per household per year.

What you’ll get

You won’t have to pay for your TV licence. This is the case for everybody in your household, as the TV licence is paid for on a household-by-household basis.

Are you eligible?

You can get a free TV licence in the UK if you (or somebody else in your household) are aged 75 or over and claims pension guarantee credits.

You can also get a free TV licence if you live in a care home.

Meanwhile, if you’re registered blind as a result of a visual impairment, you can get a 50% discount on your TV licence, regardless of age.

How to claim

Once you turn 75, you’ll need to apply for your free TV licence. You can do this by applying online, or by contacting TV Licencing on 0300 790 6117.

Free dental care and eye tests through the NHS

What is it?

People above a certain age in the UK (usually 60) can receive a range of free or discounted treatments, prescriptions and checkups through the NHS.

What you’ll get and are you eligible?

In the UK, everyone aged over 60 is eligible for free prescriptions and NHS eye tests.

You’re also eligible for free NHS dental treatment if you or your partner receives:

- Pension Credit Guarantee Credit

- Pension Credit Guarantee Credit with Savings Credit

If you’re aged 60 or over in Scotland or Wales, you’re also eligible for free NHS dental examinations.

Learn more about free dental treatment for over 60s.

How to claim

If eligible, these discounts will be automatically applied when you receive treatment or go for a checkup.

If a benefit is needed for a discount, be sure to take proof of this benefit (such as a certificate) with you.

We’re on a mission to support individuals and their loved ones throughout each stage of their later living journey. For more information, check out everything Lottie has to offer.

Free Care Fees & Funding Email Course

Written by our team of experts and designed to help families fund later life care in England.