PIP Freebies and Discounts 2024 | What You Could Be Missing Out On

Estimated Reading Time: 11 minutes

Personal Independence Payment (PIP) is a benefit for people below the State Pension age who need assistance with living costs as a result of a medical condition, disability or illness. If eligible, you’ll get a payment worth up to £184.30 a week, and you may also be eligible for 11 additional PIP freebies, discounts and concessions worth thousands of pounds, including council tax discounts, free NHS prescriptions and blue badges.

These bonuses help with healthcare and the rising cost of living, while also making some bills and travel more affordable. People living with a disability face several disadvantages, so these concessions are aimed at levelling the playing field. We’ve gone over what each of these is below, along with how to claim them and whether you're eligible, as receiving PIP doesn't guarantee eligibility for all of these.

Arrange care at home

Browse the best home care in your area.

We aren't able to provide Personal Independence Payment (PIP) advice through our concierge service. For help when trying to claim PIP, call the PIP claims contact number on 0800 917 2222. Citizens Advice, Turn2us and many local authorities can also provide free and confidential PIP advice.

How Much Does Personal Independence Payment (PIP) Pay?

PIP is paid across two components, with each of these components containing two separate rates (depending on how much help you require). You’ll get the daily living component if you need help with everyday tasks, while you’ll get the mobility component if you need help with getting around (both inside and outside of your home).

The standard rate of the PIP daily living component is worth £72.65 a week, while the enhanced rate is worth £108.55 a week.

The standard rate of the PIP mobility component is worth £28.70 a week, while the enhanced rate is worth £75.75 a week.

For more information, we have an article explaining PIP rates for 2024/2025.

What PIP Freebies and Discounts Can You Get?

Along with a financial boost worth up to £184.30 a week (if you receive the enhanced rate for the daily living and mobility components), claimants may also be eligible for 11 PIP discounts and concessions, including a council tax reduction and discounts on travel. A PIP award letter or notice is often needed to apply for these.

What PIP freebies, discounts and concessions are there?

- Blue badge

- Capped water bills

- Council Tax discounts

- Disability premium

- Disabled Facilities Grant

- Discounted days out

- Free prescriptions

- Motability Scheme vehicle

- Toll roads

- Transport discounts

- Vehicle tax reduction

You can use the money from PIP to help pay for care at home, and we can assist you in finding the best home carer for your or your loved one’s care needs. You can request a free home care shortlist, where we’ll match you with suitable home care agencies that have availability in your local area.

1. Blue badge (for parking)

Your PIP award letter can be used to apply for a blue badge (also known as a disabled badge). Some councils may charge for this, but the most they can ask you to pay is £10. This badge is displayed on the windscreen of your car.

A blue badge makes you exempt from certain parking restrictions while also giving you access to designated parking spaces. These reserved parking spaces tend to be larger and nearer entrances.

Blue badge holders could also get free or discounted on-street parking.

A blue badge holder can even park on single or double yellow lines for a maximum of three hours, provided there aren’t any loading or unloading restrictions.

To be eligible, you’ll need to have a disability that limits your movement and ability to walk.

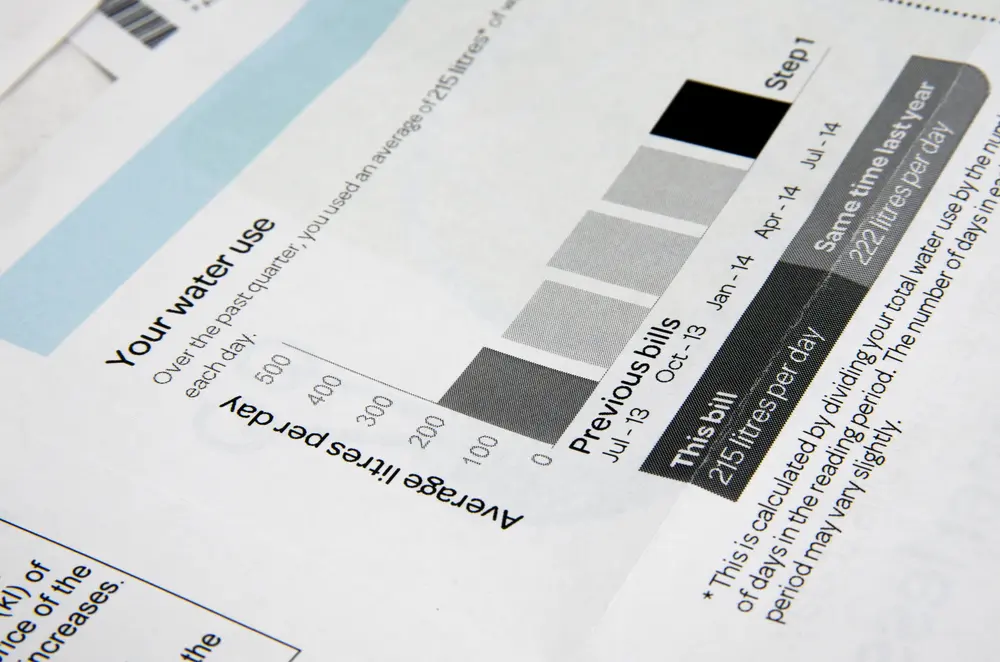

2. Capped water bills

Some people who receive Personal Independence Payment or Disability Living Allowance will be eligible for help with paying their water bills through the WaterSure Scheme.

You could be eligible if you or somebody else in your household has a medical condition that requires the use of a lot of water. Your household will also need to be on a water meter (or you’ve applied for one).

Eligibility varies from water supplier to water supplier, so we’d recommend getting in touch with your supplier to see if they’re offering any support. If you aren’t sure who your water supplier is, you can find out here by entering your postcode.

3. Council Tax discounts

You could be eligible for a Council Tax discount if you receive the daily living or mobility component of PIP. You should get in touch with your local council to find out whether you’re entitled to a discount.

You might need to show your PIP letter as proof of receiving the benefit.

How big a discount you’re eligible for depends on your personal circumstances and which rates and components of PIP you receive. This can also be discussed with your local council.

Data shows that around 2.8 million people in the UK don’t take advantage of the Council Tax discount, with £2.7 billion going unclaimed each year. These figures indicate that the average discount is worth around £975 (but it could apply to your entire bill).

If you’re classed as ‘severely mentally impaired’, you could be eligible for a complete exemption, meaning you’ll be disregarded from paying any council tax at all.

4. Disability premium (benefit top-ups)

If you claim PIP and qualify for a disability premium, you could receive one of the following amounts as an additional payment:

- £39.85 a week if you’re single (disability premium)

- £56.80 a week if you’re in a couple (disability premium)

- £76.40 a week if you’re single (severe disability premium)

- £152.80 a week if you’re in a couple and are both eligible (severe disability premium)

- £19.55 a week if you’re single (enhanced disability premium)

- £27.90 a week if you’re in a couple and at least one of you is eligible (enhanced disability premium)

To be eligible for a disability premium, you’ll also need to receive one of the following benefits alongside PIP:

- Housing Benefit

- Income-based Jobseeker’s Allowance

- Income-related Employment and Support Allowance (only if you get the daily living component of PIP)

- Income Support

- Pension Credit (only if you get the daily living component of PIP)

- Working Tax Credit

5. Disabled Facilities Grant

If you have a disability and require changes to make your home easier to live in, you can apply for a Disabled Facilities Grant.

You need to be assessed to check your eligibility for a disabled facilities grant. Not everyone who is eligible for PIP is also eligible for one of these grants.

In England, the maximum grant amount is £30,000, while the maximum grant amount in Wales is £25,000. These grants aren’t available for households in Scotland.

Common examples of home modifications made using a Disabled Facilities Grant include:

- Widening doorways (for better wheelchair access)

- Installing ramps or grab rails

- Installing a stairlift

- Building an extension, such as a downstairs bedroom

- Heating or lighting controls

- Lowering kitchen worktops

- Fitting a wet room or lower-access shower

6. Discounted days out

If you have a carer, they may be entitled to discounts or free entry at attractions throughout the UK. For example, National Trust and English Heritage offer free entry to a carer through the Essential Companion Card. This card isn’t compulsory, it just makes the entry process quicker.

Similarly, the UK Cinema Association offer CEA cards that will provide your carer with a free ticket at participating cinemas.

All Merlin Entertainment attractions also offer one complimentary pass per disabled person. Buying a Merlin Annual Pass will get you a free Carer Pass which can be used by anyone assisting you on the day.

In all of these cases, all you’ll need to do is show proof of disability, such as a PIP letter dated within the past two years.

7. Free prescriptions

If you have a medical condition that makes you eligible for PIP, you may also qualify for free NHS prescriptions.

Not all medical conditions qualify though. Some conditions that do qualify include cancer, diabetes and epilepsy, as well as physical conditions that prevent you from going outdoors without assistance.

To get these free prescriptions, you’ll need to apply for a medical exemption certificate (MedEx).

The full list of eligible conditions and how to apply can be found on the NHS Business Services Authority website.

You can also speak to your local pharmacy to see what they offer, as the medicines covered by the scheme can vary from location to location.

8. Motability Scheme vehicle

If you’ve been awarded the enhanced rate of the mobility component of PIP and have 12 months or more remaining on your current allowance, you could be eligible to join the Motability Scheme.

Here, you can trade some or all of your PIP earnings from this component (currently £75.75 a week at the enhanced rate) towards the cost of a brand-new car, wheelchair-accessible vehicle, scooter or powered wheelchair.

Through the Motability Scheme, you’ll have over 2,000 cars to choose from, with insurance, tax and servicing all included!

9. Toll roads

The majority of toll roads and congestion schemes in the UK offer a concession to disabled people, such as those who claim the enhanced rate mobility component of Personal Independence Payment.

This discount includes river crossings, bridges and tunnels.

Here’s a full list of toll concessions in the UK.

10. Transport discounts

A disabled person’s bus pass is distributed by local councils as part of the English National Concessionary Travel Scheme. Get in touch with your local council to find out more about free local bus travel.

You can also get up to a third-off rail fares through a Disabled Person’s Railcard if you receive PIP. The Disabled Person’s Railcard costs £20 per year or £54 for three years. Average annual savings are around £91, but this will depend on how often you get the train.

We have a guide explaining other public transport concessions you could be eligible for.

11. Vehicle tax reduction

If you receive the mobility component of PIP at the standard rate, you can get a 50% deduction on any vehicle tax you pay (this is the same as road tax).

Some people pay up to £2,355 a year on vehicle tax, so this 50% discount can save you well over £1,000 annually.

The vehicle you’re getting this 50% tax discount on must be registered in the disabled person’s name (or in the name of their nominated driver).

You can claim this discount when applying for vehicle tax. If you’re claiming for a vehicle for the first time, you’ll need to claim at your local Post Office branch.

If you receive the mobility component at the enhanced rate, you can apply for a complete vehicle tax exemption instead.

PIP Application Process

To claim PIP over the phone, call the PIP new claims phone line on 0800 917 2222.

You can also apply by post, but doing so this way will mean you’ll have to wait longer for a decision.

To apply by post, send a letter to the following address:

Personal Independence Payment New Claims Post Handling Site B Wolverhampton WV99 1AH

You’ll then be sent a form asking for your personal information, followed by another asking about your disability or condition. Fill these in and send them back to the address above.

In some areas, you can apply online as well. You’ll need to check your postcode when applying to see if you’re able to do so online.

When making a PIP application, you’ll need to provide the following information:

- Contact details

- Date of birth

- National Insurance number (if you have one)

- Bank or building society account details

- Your doctor or health worker’s name, address and contact details

- Time spent in a care home or the hospital, along with the addresses of these

- Any countries you’ve visited for more than four weeks at a time, along with the dates you were there

Lottie matches care seekers with the best home carers for their care needs. You can request a free list of home care agencies, where we’ll find you home care providers with availability in your local area.

Frequently Asked Questions

Do PIP claimants get an energy payment?

PIP claimants could also be entitled to a cost of living payment worth up to £1,200 to help with energy bills.

You could be eligible if you receive any of the following benefits:

- Employment and Support Allowance (only if you receive the daily living component of PIP)

- Housing Benefit

- Income Support

- Jobseeker’s Allowance

- Pension Credit (only if you receive the daily living component of PIP)

- Working Tax Credit

Will PIP claimants get a bonus?

PIP claimants are also eligible for a one-off, tax-free £10 payment. This is made before Christmas, usually in the first full week of December. You should be sent this payment automatically, so there’s no need to make a claim for it.

Free Care Fees & Funding Email Course

Written by our team of experts and designed to help families fund later life care in England.