Carer’s Allowance Explained | How This Benefit Works

Estimated Reading Time: 11 minutes

Carer’s Allowance is the main benefit that carers can receive. If you’re looking after someone for 35 hours a week or more, you may be eligible.

Here, we’ve covered everything you need to know about Carer’s Allowance, including how it works, how to claim Carer's Allowance and what to do if you receive any other benefits.

Arrange care at home

Browse the best home care in your area.

In this article on carer’s allowance:

- What is carer’s allowance?

- How much does carer's allowance pay?

- How is carer’s allowance paid?

- What are the conditions for claiming carer’s allowance?

- How can I claim carer’s allowance?

- Changes of circumstances

- Backdating a claim

- If you think the decision is wrong

- Other benefits

- What to do if you get other benefits

What is Carer’s Allowance?

Carer’s Allowance is a benefit for people who are providing regular and substantial care to somebody who isn’t able to look after themselves on a daily basis. If you’re caring for a family member or someone else, you may be eligible for additional financial support.

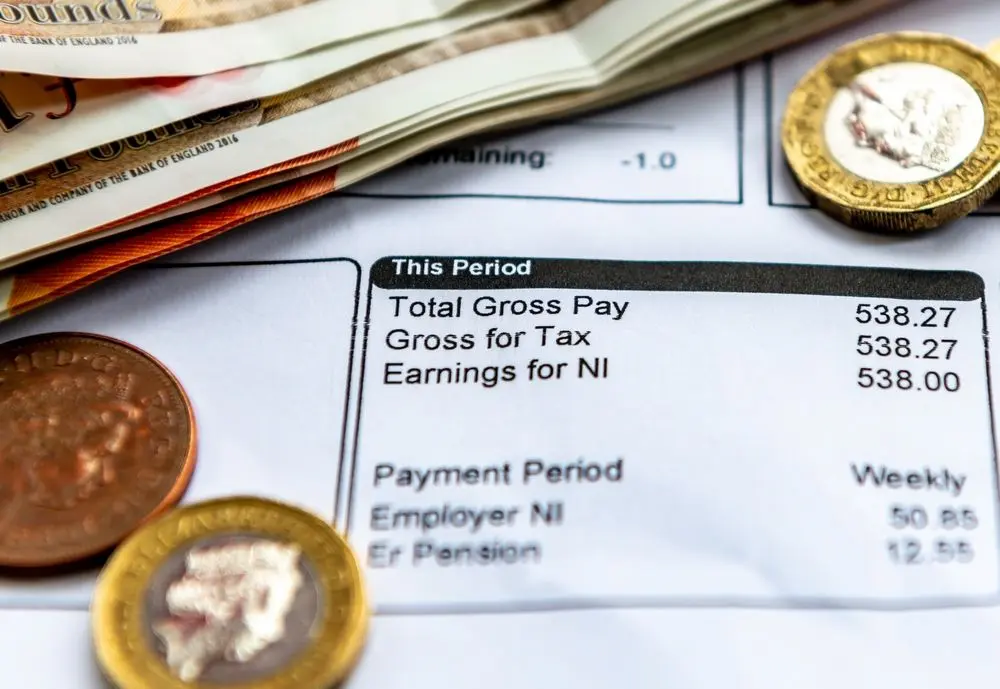

Carer’s Allowance is a taxable benefit that forms part of your taxable income. This is known as the main benefit for carers. If you look after a loved one or somebody else for 35 hours a week or more then you may be eligible.

How Much Does Carer's Allowance Pay?

Carer’s Allowance is paid at a standard rate for the person making the claim. The 2024/2025 Carer’s Allowance rate is £81.90 a week.

You can check the current rate of Carer’s Allowance on GOV.UK.

This carer benefit isn’t based on your income and capital (or that of any partner). This also means that there’s no cap on how much you can earn from work while still being entitled to Carer’s Allowance.

Though this benefit is taxable, you’ll only have to pay tax if you have other sources of taxable income, such as occupational or personal pensions, or other part-time earnings that take you over the tax-paying threshold (up to £12,570) when combined with what you get for Carer’s Allowance. On its own, Carer’s Allowance is below this threshold.

How is Carer’s Allowance Paid?

Carer’s Allowance is normally paid directly into a bank account, building society or Post Office card account. If you aren’t able to open or manage an account then the Department for Work and Pensions will pay you using the Payment Exception Service.

You can choose to be paid weekly in advance or every four weeks.

As long as you’re eligible, you’ll continue receiving Carer’s Allowance.

What are the Conditions for Claiming Carers Allowance?

To be eligible, you need to meet certain criteria, including providing at least 35 hours of care a week to one person who receives a qualifying disability benefit. You also need to be aged 16 or over and not be in full-time education. Although Carer’s Allowance isn’t classed as a means-tested benefit, you won’t be eligible if you earn more than £151 a week after deducting tax, National Insurance and expenses.

The 35 hours you spend caring for someone can be at any time during the day or at night, and can also be on any day of the week. However, you can’t average out your hours over several weeks, and you can’t add together time spent caring for multiple people.

There are a range of qualifying disability benefits, including either rate of the daily living component of Personal Independence Payment, either rate of Attendance Allowance or the middle or highest rate of the care component of Disability Living Allowance.

For more information, we have an article explaining Carer’s Allowance eligibility in greater detail.

How Can I Claim Carer’s Allowance?

To claim Carer’s Allowance, you can:

- Use the online Claim Carer’s Allowance service through GOV.UK

- Download and print a Carer’s Allowance claim form. You can then fill this in and sent it by post

While you can’t make a claim by phone, if you need help then we’d recommend contacting the Carer’s Allowance Unit. Their telephone number is 0800 731 0297.

We can help you find the best home carer for you or your loved one’s care needs, including domiciliary (hourly) and live-in carers. Request a free list of home care agencies, and our care experts will match you with suitable carers with availability in your local area.

Changes of Circumstances

If you become aware of a change that might affect the amount of Carer’s Allowance you can get (or whether you’re still eligible) then you should let the Department for Work and Pensions know as soon as possible.

This change might increase your payment and you may miss out on extra money as a result if you let the Department for Work and Pensions know too late.

If you think a change might reduce your payment then you should also let the Department for Work and Pensions know. If you tell them too late then you may be paid too much and have to pay back any benefits you’ve claimed.

Backdating a Claim

Your claim can be backdated for up to three months if eligible. You don’t have to offer a reason why you’re claiming late.

If the person you care for has recently been awarded a qualifying benefit, try to claim Carer’s Allowance within three months of this award. Doing this will mean your Carer’s Allowance can be backdated to when they started their claim for the qualifying benefit - even if this was more than three months ago.

When applying, request for your Carer’s Allowance to be backdated. You should ask for this on the claim form where it states “When do you want your Carer’s Allowance to start?”

If You Think the Decision is Wrong

If you disagree with a decision that’s been made about your Carer’s Allowance claim, you can ask for it to be looked at again. This is known as a mandatory reconsideration. If you still disagree with the further decision then you can appeal to an independent tribunal.

A reason you may disagree with the decision is if you believe incorrect information has been used. You may disagree with the decision if you think you’re getting the wrong amount or if you’ve been refused Carers Allowance support.

Time limits are strict - you’ll usually be given one month to dispute a decision - so it’s really important that you quickly seek advice and take action.

If you’re unhappy with the service you’ve received from your local benefits office or the Department for Work and Pensions, you can complain. This may be down to errors, delays, rudeness or difficulty when trying to get in touch with them. You can do this regardless of whether or not you also want to challenge a decision.

Carer’s Allowance and Other Benefits

There are a variety of other benefits that carers may be entitled to, depending on individual circumstances and any other benefits you're already receiving.

We’ve gone through the most common benefits below:

Carers credit

This National Insurance credit fills up gaps in your National Insurance record. Receiving Carer’s Credit allows you to take on caring responsibilities, without affecting your ability to qualify for State Pension.

Even if you don’t qualify for Carer’s Allowance (or the Carer’s Element of Universal Credit), you may be able to claim Carer’s Credit, where entitlement to the State Pension can be built up by providing care for 20 hours a week or more.

You may be eligible for Carer’s Credit if:

- You’re aged 16 or over

- You aren’t claiming State Pension

- You don’t qualify for Carer’s Allowance

- You spend at least 20 hours a week caring for someone

- The person you care for gets a benefit because of their illness or disability (such as Attendance Allowance, Disability Living Allowance, Personal Independence Payment or Armed Forces Independence Payment)

You don’t need to apply for Carer’s Credit if you:

- Receive Carer’s Allowance (as you’ll automatically get credits)

- Receive Child Benefit for a child aged under 12 (as you’ll automatically get credits)

- Are a foster carer

To apply, download the Carer’s Credit claim form.

Pension credit

This is extra money for pensioners to bring their weekly income up to a certain amount.

This benefit can be claimed once you’ve reached State Pension age and is separate from your State Pension itself.

Pension Credit tops up:

- Your weekly income to £218.15 if you’re single

- Your joint weekly income to £332.95 if you have a partner

If you live with a partner, you’ll only be able to claim Pension Credit if you’ve both reached State Pension age. We also have a guide explaining how much Pension Credit is a week.

You could also get an extra £45.60 a week if:

- You get Carer’s Allowance

- You’ve claimed Carer’s Allowance but aren’t being paid because you already get another benefit paying a higher amount

One in three people who are entitled to Pension Credit don’t claim it, so if you think you may be eligible then be sure to check.

Apply for Pension Credit here.

Carer premium

To be eligible for a Carer Premium, you must spend at least 35 hours per week caring for someone. If a Carer Premium is received on top of other benefits it will amount to £45.60 weekly. If you claim Universal Credit then this premium is instead paid monthly at £198.31.

You may be entitled to an additional Carer Premium if you already receive:**

- Income Support

- Universal Credit (and receive the ‘carer element’)

- Housing Benefit

- Council Tax Support

- Income-based Jobseeker’s Allowance

- Income-related Employment and Support Allowance

- Pension Credit (and receive the ‘carer addition’)

To find out if you’re eligible for Carer Premium or to start receiving it, enquire at your local Jobcentre Plus or Jobs and Benefits Office. However, if you qualify then this payment will normally be automatically added to your benefit.

Local welfare assistance

If you have a sudden change to your finances or an unexpected situation arises while receiving certain benefits or when on a very low income, you may be able to get some help in the form of local welfare assistance. There are no set guidelines for this and it varies for each local authority across the UK.

England

Find your local council to see what help they can provide.

Scotland

Learn more about the Scottish Welfare Fund on the mygov.scot website.

Wales

Learn more about the Discretionary Assistance Fund on the Welsh Government website.

Northern Ireland

Learn more about the Social Fund on the nidirect website.

Additional benefits in Scotland

If you’re aged 16 to 18 and live in Scotland, you may also be able to apply for a Young Carer Grant of £359.65 a year. This new scheme started on 21st October 2019 for young carers who spend an average of 16 hours caring for people who have received a disability benefit for a minimum of three months.

You can receive this grant alongside Carer’s Allowance if you meet the criteria for both.

You can apply for a Young Carer Grant through mygov.scot.

There’s also an extra benefit for people living in Scotland who get Carer’s Allowance on a particular date - the Carer’s Allowance Supplement. If you’re already receiving Carer’s Allowance on the relevant dates then you’ll automatically get these payments.

The 2023 payment dates are as follows:

| Payment Date | Amount | Eligibility Date |

|---|---|---|

| From June 2023 | £270.50 | You’ll get this payment if you’re receiving Carer’s Allowance on 10th April 2023 |

| From December 2023 | £270.50 | You’ll get this payment if you’re receiving Carer’s Allowance on 9th October 2023 |

What to Do if You Get Other Benefits

You’ll get no Carer’s Allowance or a lower amount of it if you receive certain other benefits, including:

- State Pension

- Contributory Employment and Support Allowance

- Contribution-based Jobseeker’s Allowance

- Maternity Allowance

If your Carer’s Allowance is either the same as or less than the other benefit, you’ll get the other benefit instead of Carer’s Allowance.

If the other benefit is less than your Carer’s Allowance, you’ll get the other benefit and the balance of your Carer’s Allowance on top.

If you get any income-based benefits

These types of benefits are known as ‘means-tested benefits’. Carer’s Allowance counts as income when these benefits are worked out.

If you’re eligible for Carer’s Allowance - regardless of whether or not you’ve applied for it - you’ll receive an extra amount of Universal Credit known as a ‘carer’ element.

You can also get an extra amount of money called a ‘Carers Premium’ or ‘Carers Addition’ added to any of the following benefits if you get Carer’s Allowance:

- Pension Credit

- Income-based Jobseeker’s Allowance

- Income-related Employment and Support Allowance

- Income Support

- Housing Benefit

- Council Tax Support

We’re on a mission to support individuals and their loved ones throughout each stage of their later living journey. For more information, check out everything Lottie has to offer.

Frequently Asked Questions

How many hours can I work when on Carer’s Allowance?

As long as you spend at least 35 hours in your caring role, you can work and get Carer’s Allowance. So in theory, there’s no limit to the number of hours you can work professionally while still being eligible.

You can get support for yourself or the person you care for from your employer, local councils and other organisations.

Free Care Fees & Funding Email Course

Written by our team of experts and designed to help families fund later life care in England.