The Benefit Cap | How Much Is It and Does It Apply To You?

Estimated Reading Time: 7 minutes

Introduced in 2013, the benefit cap limits the maximum amount of benefits a working-age person or household can receive. This maximum amount depends on your personal circumstances, such as whether you live in London and if you’re single or in a relationship.

This cap was increased in April 2023 for the first time, by 10.1% in line with inflation and various DWP and HMRC benefits.

Below, we’ve explained how the benefit cap works and which benefits are and aren’t counted.

Arrange care at home

Browse the best home care in your area.

In this article:

- What is the benefit cap?

- Benefit cap amounts 2024

- When is the benefit cap applied?

- Grace periods for Universal Credit and Housing Benefit

- Which benefits are affected by the cap?

- Which benefits aren’t affected by the benefit cap?

- Other benefit cap exemptions

- Work out whether the benefit cap applies to you

What Is the Benefit Cap?

The benefit cap is the maximum amount that people of working age (below the State Pension age) can receive.

This benefit cap applies to claimants and their spouse/civil partner/cohabiting partner and any dependant children who live in the same household.

The benefit cap applies to England, Scotland, Wales and Northern Ireland.

The Department for Work and Pensions (DWP) say the main aim of the benefit cap is to reduce spending on benefits and guide more people into work.

Benefit Cap Amounts 2024

The maximum amount of benefits you can get for a household depends on whether:

- You live inside or outside Greater London

- You’re single or in a relationship

- Your children live with you (if you’re single)

Below are the current benefit cap amounts. These came into effect in April 2023.

| Your Personal Circumstances | Weekly Benefit Cap | Monthly Benfit Cap | Annual Benefit Cap |

|---|---|---|---|

| If you live outside London (couples, or single parents with dependent children) | £423.46 | £1,835.00 | £22,020.00 |

| If you live outside London (single adults without children, or whose children don’t live with them) | £283.71 | £1,299.42 | £14,753.00 |

| If you live in Greater London (couples, or single parents with dependent children) | £486.98 | £2,110.25 | £25,323.00 |

| If you live in Greater London (single adults without children, or whose children don’t live with them) | £326.26 | £1,413.92 | £19,967.00 |

In line with inflation and certain benefits, the benefit cap rose by 10.1% in April 2023. As a result, it increased by the following amounts annually:

Couples, or single parents with dependent children (outside London) - £2,020

Single adults without children, or whose children don’t live with them (outside London) - £1,353

Couples, or single parents with dependent children (inside London) - £2,323

Single adults without children, or whose children don’t live with them (inside London) - £1,557

We can help you find the best home carer for you or your loved one’s care needs, including domiciliary (hourly) and live-in carers. Request a free list of home care agencies, and our care experts will match you with suitable carers with availability in your local area.

When Is the Benefit Cap Applied?

The benefit cap is the total amount of benefits a single household can receive (this could be an individual living by themselves, or someone living with a partner and/or any dependant children).

The cap is applied by reducing people’s Housing Benefit or monthly Universal Credit payments. These benefits will be reduced until you fall below the cap. Doing this ensures the total amount of benefits you get isn’t greater than the benefit cap.

However, when it comes to Universal Credit, reductions don’t include the childcare cost element. If this element is more than the excess benefit, a reduction isn’t applied.

If you don’t receive either of Housing Benefit or Universal Credit, you won’t be affected by the benefit cap.

Grace Periods For Universal Credit and Housing Benefit

If you claim Universal Credit, the benefit cap won’t be applied for a nine-month grace period if (all of the below need to apply):

- You’re claiming Universal Credit because you stopped working or your earnings decreased

- In each of the 12 months before you stopped working or your earnings went down, you earnt the same as or greater than the earnings threshold (this is £722 per month from April 2023)

- You now earn less than £722 a month

You’ll need to report your last 12 months’ earnings when applying for Universal Credit to be eligible for this grace period.

If you claim Housing Benefit, the benefit cap won’t be applied for a 39-week grace period if (both of the below need to apply):

- You (or your partner) were working for at least 50 of the previous 52 weeks

- While you (or your partner) was working, you weren’t entitled to Income Support, Jobseeker’s Allowance or Employment and Support Allowance

Which Benefits Are Affected By the Cap?

The benefit cap will apply if you or your partner is of working age and receives either of Housing Benefit or Universal Credit.

The DWP will add together the total amount you receive of the following benefits to work out whether you’re under or over the benefit cap:

- Bereavement Allowance

- Child Benefit

- Child Tax Credit

- Employment and Support Allowance (except when you’re placed in a support group)

- Housing Benefit (except for households in Supported Exempt Accommodation)

- Incapacity Benefit

- Income Support

- Jobseeker’s Allowance

- Maternity Allowance

- Reduced Earnings Allowance

- Severe Disablement Allowance

- Universal Credit (except the Childcare Costs element)

- Widowed Parent’s Allowance, Widowed Mother’s Allowance and Widow’s Pension

Which Benefits Aren’t Affected By the Benefit Cap?

If you, your partner or any child aged under 18 living with you receives any of the following benefits, you won’t be affected by the benefit cap:

- Adult Disability Payment (ADP)

- Armed Forces Compensation Scheme

- Armed Forces Independence Payment

- Attendance Allowance

- Carer’s Allowance

- Child Disability Payment

- Disability Living Allowance (DLA)

- Employment and Support Allowance (if you receive the support component)

- Guardian’s Allowance

- Industrial Injuries Benefits (along with equivalent payments within the War Disablement Pension or Armed Forces Compensation Scheme)

- Personal Independence Payment (PIP)

- Universal Credit (if you receive the Carer’s Element or Limited Capability for Work Related Activity element)

- War Disablement Pension

- War Widow’s or War Widower’s Pension

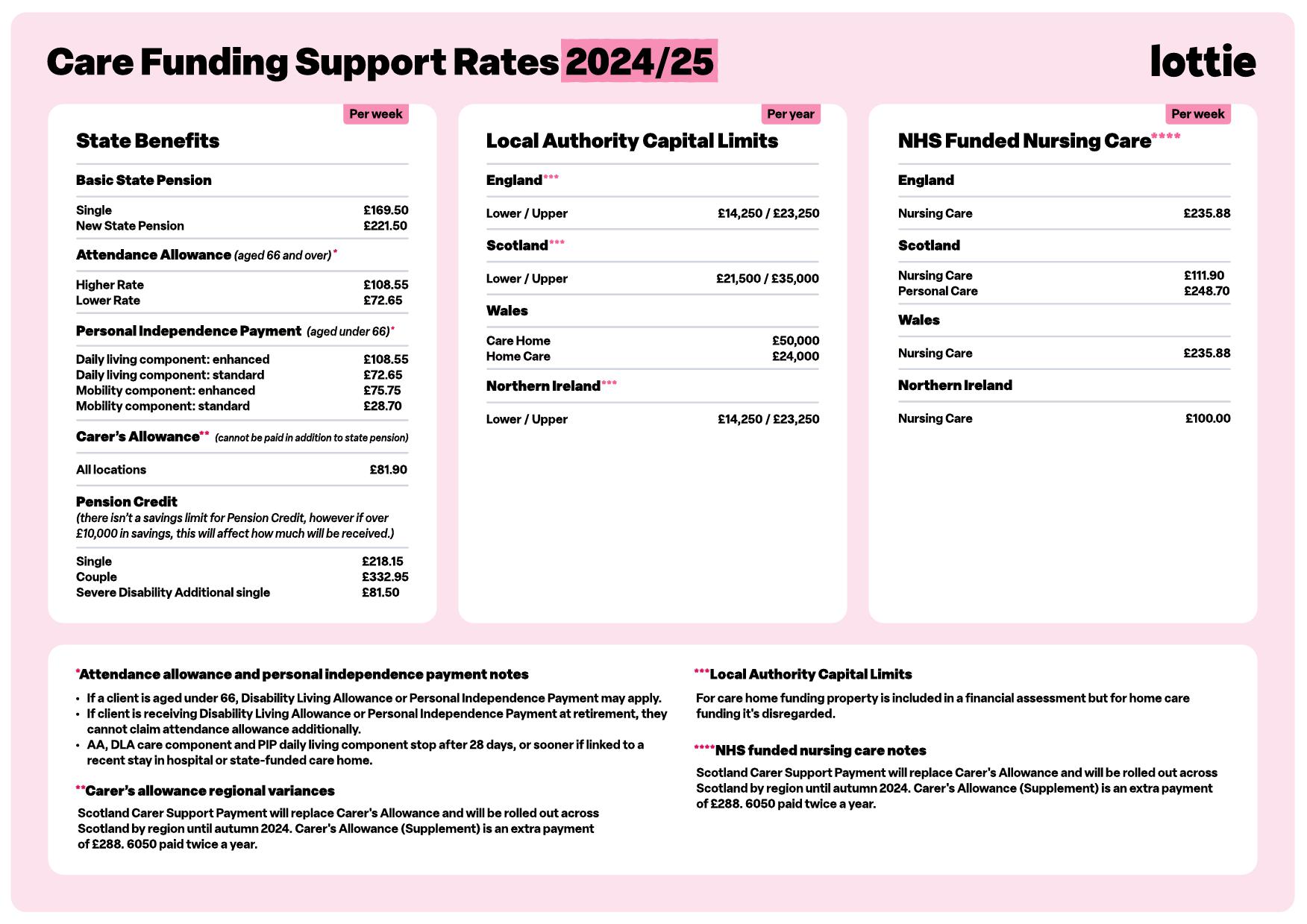

Here are the 2024/2025 care funding support and benefit rates, including for many of the above benefits:

Other Benefit Cap Exemptions

You’ll be exempt from the benefit cap if you’re above the State Pension age.

The following benefits aren’t counted towards the cap when adding up what your household receives:

- A discretionary housing payment

- Localised council tax support

- Social fund payments

- Statutory maternity, paternity or adoption pay

- Statutory sick pay

- Winter fuel payment

- Any other cost of living payments

The cap also doesn’t apply if you fall under any of these circumstances:

- You’ve lost a job

- You work enough hours to qualify for a working tax credit

- You claim Universal Credit and earn above a certain amount (£722 a month)

- You’re a lone parent with children below school age

Work Out Whether the Benefit Cap Applies To You

There are several calculators that will show what you’re entitled to, whether you’re affected by the benefit cap and whether you’re above or below it if so.

Some of the most popular benefit calculators include:

We’re on a mission to support individuals and their loved ones throughout each stage of their later living journey. For more information, check out everything Lottie has to offer.

Frequently Asked Questions

How does the benefit cap work when I have two housing benefit claims under different local authority areas?

If you have two housing benefit claims - both of which are within different local authority areas - the Department for Work and Pensions (DWP) has provided guidance as to how the benefit cap should be applied.

Does the benefit cap still apply?

Generally speaking, the benefit cap does still apply. However, there are several circumstances in which you’ll be exempt, such as if you receive certain benefits. If you’re above the State Pension age, the benefit cap also won’t apply to you.

How much do I need to earn to stop the benefit cap?

If you get Universal Credit and earn at least £722.45 a month after tax and National Insurance deductions, the benefit cap doesn’t apply to you. These earnings can come from an employer or through self-employment.

Free Care Fees & Funding Email Course

Written by our team of experts and designed to help families fund later life care in England.